44+ rental property mortgage interest deduction

Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. 16 2017 of secured mortgage debt on your first or second home.

Mortgage Interest Deduction Faqs Jeremy Kisner

Homeowners who bought houses before December 16.

. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Get Instantly Matched With Your Ideal Mortgage Lender.

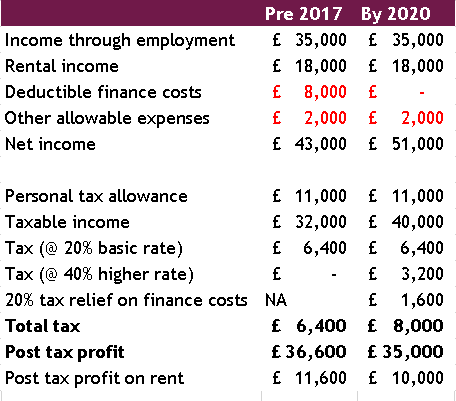

But for loans taken out from. Web Still you can deduct interest on up to 750000 1 million if you took out the mortgage before Dec. Rental income 18000 Finance costs 8000 nil deduction Other allowable expenses - 2000 Property profits 16000.

Web This doesnt mean they werent eligible for the mortgage deduction all the same. We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can. Web You can deduct the costs of certain materials supplies repairs and maintenance that you make to your rental property to keep your property in good.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Instead these expenses are added to your basis in the. It does mean their taxes didnt go down at all for incurring mortgage interest.

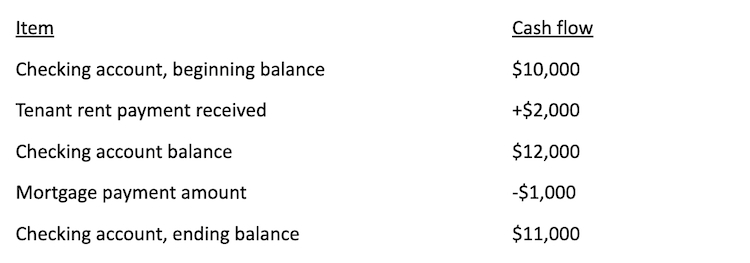

Web Property income calculation. Lock Your Rate Today. Web Owning a rental property whether a long-term short-term or vacation rental can be an exciting investment opportunity.

Web If you receive rental income for the use of a dwelling unit such as a house or an apartment you may deduct certain expenses. Web Mortgage interest. These expenses which may include.

Apply Get Pre-Approved Today. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. 16 2017 and later.

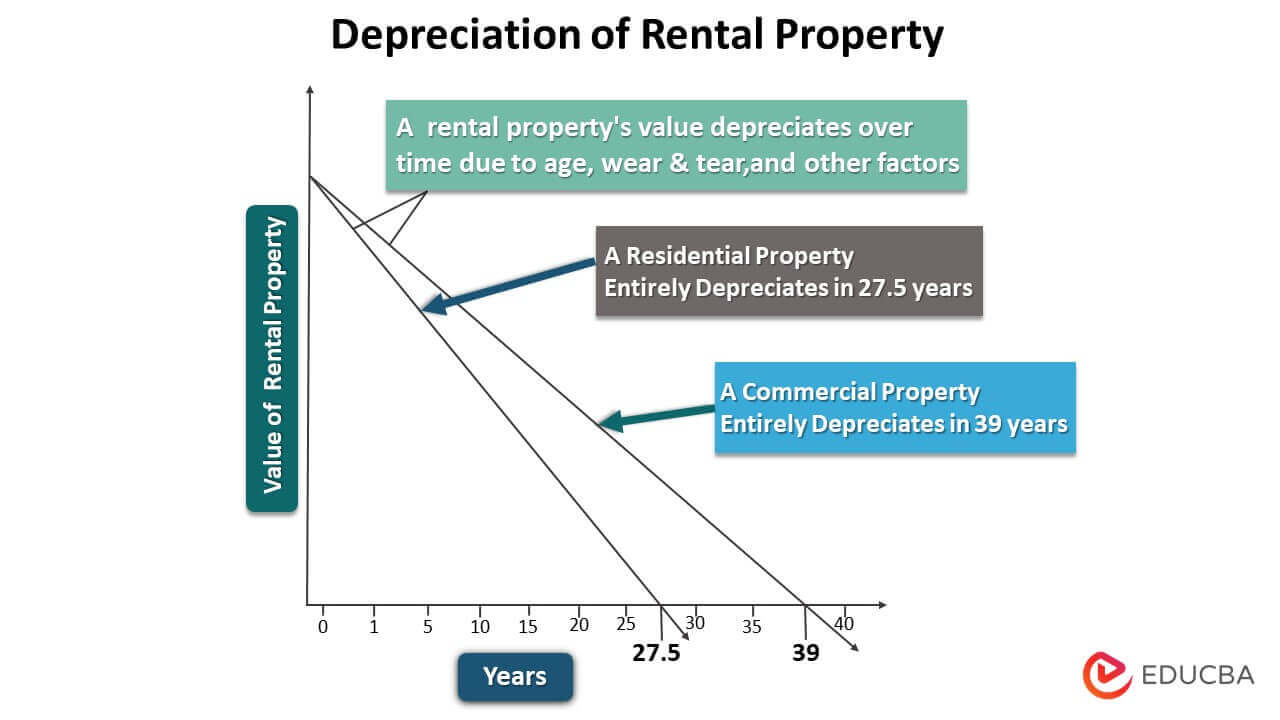

Web We have some options there. Ad Compare the Best Home Loans for February 2023. Web There are many tax benefits of owning a rental property including a depreciation deduction mortgage interest deduction as well as other business-related.

Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. You can deduct the interest on up to 750000 of mortgage debt or up to 375000 if youre married and filing separately.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Not only do investors have the.

Can You Deduct Mortgage Interest On A Rental Property Youtube

Landlord Tax Changes Come Into Effect April 2017

Tax Deductions On Home Loan Hra For Self Occupied House Property Mymoneysage Blog

6 Free Real Estate Investment Agreement Templates Pdf Word

Mortgage Interest Deduction How It Calculate Tax Savings

Is Your Mortgage Considered An Expense For Rental Property

Depreciation For Rental Property How Does It Work Eligibility Examples

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Is Interest Paid On Investment Property Tax Deductible

6 Free Real Estate Investment Agreement Templates Pdf Word

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

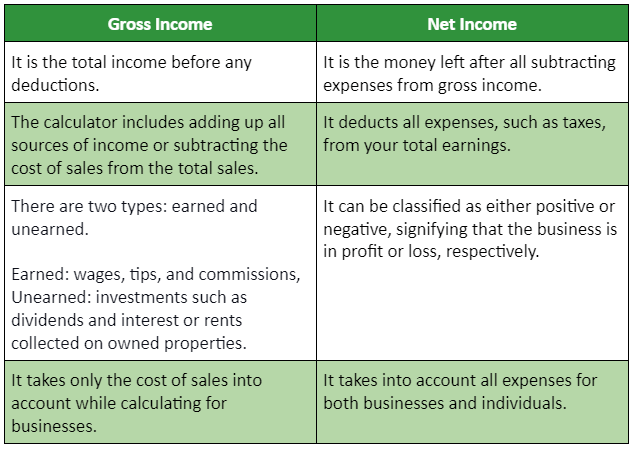

Gross Income Definition Formula Calculator Examples

Can You Deduct Mortgage Interest On A Rental Property Youtube

How Federal Income Tax On Rental Properties Works Real Group Real Estate Chicago S Premier Residential Re Team

Pdf The Influence Of Capital Requirement Of Basel Iii Adoption On Banks Operating Efficiency Evidence From U S Banks

Pdf Lane M F Landholding At Pa Ki Ja Na Michael Lane Academia Edu

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget